February 28, 2025/Midnight

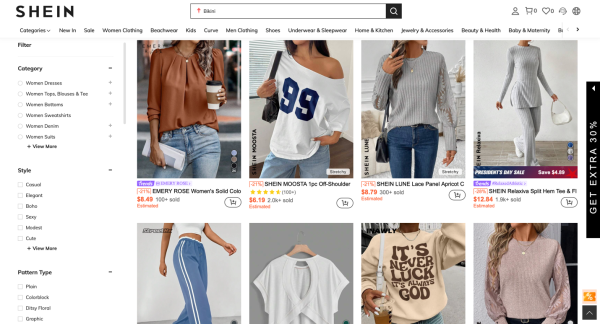

Erie, PA.- In 2024, a young woman bought $200 worth of clothes from Shein, a popular Chinese fashion app. All she had to pay was the total, plus shipping costs.

However, one year later, she returns and buys a similar order. She meets unexpected surprise – a $35 price increase due to recent tariff regulations.

This price hike hit the U.S. when President Donald Trump returned to the White House last January and imposed executive orders on tariffs. The countries experiencing an increase in tariffs include Canada, Mexico, and China.

The tariff increase drives up the costs of imported products, forcing consumers to pay more at checkout than before. It reduces the range of choices available to shoppers. Consumers who bought international goods now must search for cheaper domestic replacements.

Tariffs are taxes imposed by the U.S. government on goods brought in from foreign countries. Douglas A. Irwin, an economics professor from Dartmouth College, and an expert on U.S trade policy, describes tariffs as serving “to raise revenue for the government, to restrict imports and protect domestic producers from foreign competition, and to reach reciprocity agreements that reduce trade barriers.”

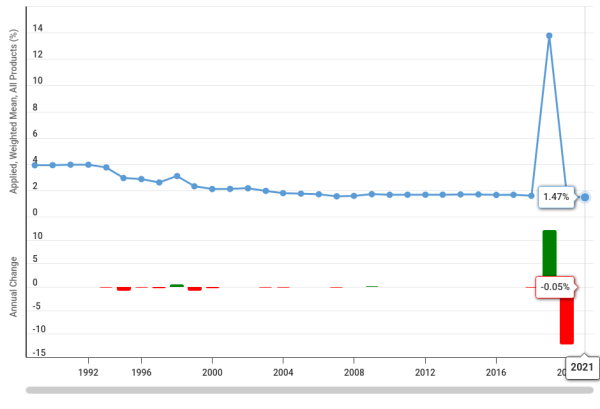

The U.S. government first imposed tariffs in 1789. Before World War II, U.S. import taxes were high, at some points, they could reach up to 50-60%, making the U.S. one of the most protectionist economies in the world.

From the 1950s to 2016, the U.S. promoted free trade, lowered tariffs, and embraced global economic integration. These policies allowed the free flow of products across the borders, fostering international trade. However, the Trump administration marked a shift in trade policy and advocated for the imposition of steep tariffs on imports.

Tariffs are used as a tool to protect domestic jobs and industries. The tariff regulations are designed to cut down the practice of American manufacturers producing goods abroad and then importing finished products back to the U.S.

The practice of outsourcing labor to low-wage countries leads to a rise in unemployment in the U.S. During Trump’s campaign in 2024, in which he vowed that “…under the plan, American workers will no longer be worried about losing your jobs to foreign nations. Instead, foreign nations will be worried about losing their jobs to America.”

Taxes are key sources of government revenue, but spending continues to outpace income, contributing to mounting financial pressures. According to Fiscal Data, until 2024, the total federal debt was $35.46 trillion and led to stalling projects and financial restraints.

According to President Trump, there was an error in tariff policy which was a rule called “de minimis.” It allowed imported products that have a value under $800 to enter the U.S. without experiencing any taxes. Trump eliminated it, and ensured that all imported goods face the tariffs.

Under Trump’s new executive orders, Canada and Mexico have to face 25% tariffs on all items, apart from Canadian energy will be subject to a lower rate of 10%. After the Trade War 2018-2019, President Trump applied specific rates to different strategies, and now taxes on all Chinese imports will be increased by 10%.

The tariffs on Chinese products were put into effect on February 4, 2025. However, orders for Canada and Mexico have been delayed for one month following the negotiations between leaders. They are working to secure the best trade agreement.

Jordan Baird, a sophomore in journalism at Gannon University, said that as a consumer she had heard about tariffs during President Trump’s campaign but initially did not fully understand them or how they impact consumers.

Professor Kurt E. Hersch, an assistant teaching professor at the Dalhkember School of Business of Gannon University, said that according to him just 20% of American customers understand tariffs. So why are tariffs important and how do they affect consumers?

Hersch said that tariffs are normally paid by the importing company to the U.S. government. When facing increased taxes, companies can maintain their prices by reducing their profit, but it is unlikely. “So they typically pass on that expenses increase to the consumers.” Hersch said.

According to Reuters, Germany’s ZF, a global company in automotive technology, has warned that they might slightly raise product prices if new tax regulations are implemented. The company has 13 operations in Mexico that manufacture a wide range of car components, including suspension systems, brakes, and steering wheels.

Temu and Shein, two giant Chinese online shopping websites, have gained significant popularity among American consumers for their vast product selection and low prices. However, both platforms have recently raised prices on certain items, signaling a shift in their pricing strategies. In addition, they are collaborating with suppliers to move their manufacturing operations outside of China with the aim of reshaping their supply chains.

Increasing tariffs can reduce the variety of products available to consumers. When the government establishes higher taxes on imports, the cost of bringing products into the country rises. In response, many retailers are forced to raise prices or even remove products from their shelves if the new prices are unacceptably high.

This shift can create a significant impact on consumers who usually use international products for their needs or preferences. The U.S is known as home to many immigrants from all corners of the globe. Many rely on cooking ingredients and household items that are staples in their native countries. However, the new executive order makes it even more difficult than before to access these familiar products.

High tariffs affect consumer’s purchasing decisions, and stretch household budgets. Baird noted “I think that Americans have already kind of started to boil down their shopping to a little bit more of just the necessities.” She added that she has personally cut out many non-essential expenses.

Professor Hersch explained that the impact of import taxes on consumers depends on market competition. In highly competitive industries, customers can quickly adjust their buying habits to avoid price hikes.

However, for essential products with limited alternatives—such as insulin—switching suppliers is nearly impossible. In these cases, consumers have no option rather than paying higher costs.

Tariffs were originally designed with good purpose but increasing them might unintentionally cause consequences, affecting not only businesses but also consumers. Hersch described that tariffs could contribute to price increases and rising inflation in long term.

Baird said she supports tariffs, as long as they remain adjustable and keep price increases within a reasonable range. However, with costs rising sharply right now, she finds it is difficult for her to advocate for them.

Trump’s administration is expected to impose more new orders with international trade and tariffs. According to Reuters, besides announcements about tariffs toward Canada, Mexico, and China, President Trump also mentioned tariffs with other countries. He mentioned that the UK could avoid U.S tariffs however, those with the European Union would “definitely happen.” Further information about tariffs can be found here.